New system introduced: How is your Credit rating?

Sweeping new changes to the credit ratings system were introduced on March 12, so, how does this affect you?

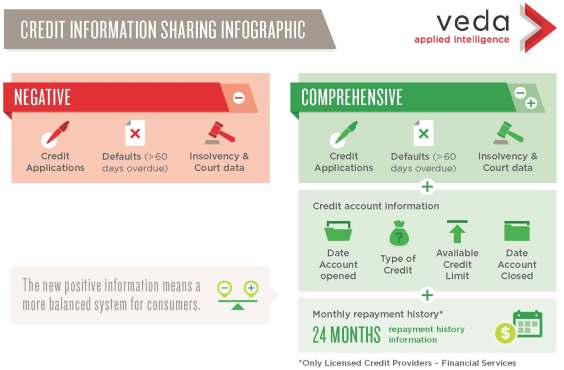

Many more details of credit, loans, credit card and account payments are now available to lending institutions - it's not just the bad, but also the good that's recorded.

The new Comprehensive Credit System (CCR) gives a far more balanced look at the consumer's whole payment history such as: when an account was opened/closed; credit limits, types of credit accounts, details of credit account payments incl. how often bills are paid on time. This is only recorded for Australian credits and not on foreign credit information.

"This should be seen as a positive by people with a good credit rating, looking to borrow but also something to keep in mind for existing mortgage holders," explained Robert Projeski, director of Australian Mortgage Options.

"Previously credit reports had identified negative details, defaults and bankruptcies. Now lenders will have a real indication on how good a consumer is when it comes to their financial affairs. If you are behind on repayments this information will be more transparent and this can affect your standing when you apply for credit.".

A credit 'default' is recorded if a bill of more than $150 is more than 60 days overdue. "If you miss a repayment by more than five days that will be marked on your file under the new system. However a default is not marked just because you missed a repayment", explained Belinda Diprose, marketing manager of Veda credit reporting agency.

What do I need to consider?

Source: Veda

Top tips for managing your credit rating*:

- Set up direct debits to ensure bills are paid on time

- Schedule loan repayments for payday

- Keep track of credit commitments and only apply for credit when you really need it

- Credit includes things like store finance so don't neglect payments on your fridge or car

- Close any accounts you don't need

- Get your bills via email and flag them to make sure they're paid on time

- If you're having trouble meeting payments, ask for an extension or negotiate new terms

- Get a copy of your credit report so you know where you stand

"A good credit history makes you more attractive to credit providers ... It's a really important piece of that lending decision so you can get the credit you want," Ms Diprose concluded.

More detailed information and examples here.

* according to Veda.com.au

(Source: Veda.com.au, Property Observer; Louise Moeller - HS Brisbane Property marketing consultant)

Hannah's Tip of the Week

Contract Tip No. 1

There are two forms of contract recommended by the REIQ and the QLD Law Society:

a) Houses and Residential Land (9th Edition); and

b) Residential Lots in a Community Title Scheme (5th Edition)

B is the contract used for apartments.

Check that the Contract you are signing is the latest edition!

... Contract Tip No. 2 coming next week ....

Why 'private treaty' sales are the investor's friend

Private treaty sale or auction? This is a fundamental real estate question that divides prospective sellers and buyers like no other. Ask 10 different sellers/buyers and you'll get 10 different reasons for preferring auction or private-treaty (fixed price) selling.

It's even more interesting if you're an investor, buying property - what is the right buying option? Auction or private treaty sale (i.e. a set price)??

To shine a bit of light onto the subject today we'll look at:

- Main reasons why people sell via auction and private treaty

- How these reasons relate to the Brisbane CBD residential apartment market

- What a well-seasoned investor says and why ...

Why properties are auctioned ...

- Rare/Unique type of property. The property is different to others in that particular market and its 'true' value is hard to properly judge. This may be true for some very unique penthouse-style CBD apartments or a rare type of unit (e.g. unusual floorplan) in a heritage-listed building. However, the large majority of CBD apartments do not fall into this category.

- Only a few recent sales comparisons, in that postcode or area. This is only true for unusual or rare styles of CBD apartment, not for the bulk of the CBD property stock.

- Sometimes preferred in order to 'speed up' a sale. The downside is that this may come at a real 'cost' to the seller. Buyers sensing the urgency to sell may then push down the price, sometimes considerably.

Why properties are sold via private treaty ...

- Sellers understand the 'true value' of their property in that market. Sellers who 'do their homework' and get reliable appraisals for a 'standard' 1, 2 or 3 bed CBD unit know what their property is worth in that market.

- It is a popular & typical type of property in that area. Most CBD properties are 1, 2 and 3bed units with or without carspace(s) in buildings that are up to about 15 years old and located in the CBD centre. These are what the vast majority of CBD buyers are predominantly looking for.

- Fixed price properties may appear to sell quicker than auctioned properties. This is according to property writer and investor, Cameron McEvoy.

- Fixed-price "properties tend to attract more genuine seekers", adds Cameron McEvoy. This may vary from market to market, but there is some inclination by certain buyers to just 'go and see what they can get out' of an auction. Buyers for a fixed-price property know where the pricing lies and may be perceived to be more qualified, researched and 'genuine'.

3 reasons why investors avoid auctions

Here are McEvoy's major reasons, as a seasoned property investor, for avoiding auctions when buying property for investment purposes:

- "I don't typically consider 'rare' or 'unique' properties for investment. This is because, as investors, it is not in our interest to do so. We'd rather hedge our bets on a property type that is high demand, so that we know it'll always be desired by renters. This helps avoid the risk of vacancy (which can crush an investors' bottom line if months and months of vacancy occur)"

- "During due diligence phases, I find non-auction [fixed-price] properties deliver more ticks on my shopping list. This extends back to property investment 101: Do your due diligence on your chosen suburb to make sure the property type you are buying, is the type that renters are wanting the most."

- "Financially, auction properties just do not stack up for me. As investors we are driven ultimately by the bottom line. Financially, there is added risk to buying investments at auction."

... in a nut-shell

"I am aware there may be other views on buying investment properties at auction, but in my experience, steering clear of auction properties in the best step investors can take to minimise risk and expedite property purchases.", concludes McEvoy.

(Source: "Why I don't buy investment properties at auction", Cameron McEvoy, Property Observer; Louise Moeller - HS Brisbane Property marketing consultant)

Hannah's Tip of the Week

CBD vs Suburbs ... lifestyle choice.

Do you work in the Inner City and are considering buying a place in the suburbs for you and the family?

Perhaps you should look at the tangible advantages of living near where you work:

- save money on transport costs to and from work

- spend more time with the family: work to home 5 minutes walk rather than long hours & stress commuting 5 days a week - year in, year out

- catch a show

- dine out somewhere different every week of the year within walking distance

- try a new trendy bar ... every Friday night

- stroll amongst the twinkling city lights

- enjoy the best fitness route every morning or evening (Goodwill bridge - Kangaroo Pt - Story Bridge and back).

It may also be the cosmopolitan lifestyle you always dreamed of!

Queensland's sunny side up!

'Sunshine State' is not just the slogan on most Queensland vehicle number-plates, it's also the current vibe in the air and in the economy.

Geared for growth

Indicators point to Queensland displaying the fastest economic growth rate across the country, according to the latest Commsec State of the States report. Queensland economic growth was up 4.2% from this same period in 2013, and is gearing up to fulfil forecasts that put the state as the fastest growing into 2014/2015 as well.

"Queensland is leading the way in business investment, with spending in the 2013 September quarter almost 27 per cent above decade-average levels," explained state Premier, Campbell Newman.

"Meanwhile, improvements in the housing sector and increased retail and tourism spending mean more jobs are being created across the state".

January 2014 "ABS data showed three-quarters of all the jobs created in Australia in the year to December were created in Queensland."

"The CommSec report has found retail spending in Queensland is up 14.7 per cent on decade average levels as both consumers and businesses continue to show sustained optimism, while tourism is also improving," summarised Acting Treasurer John McVeigh, citing massive LNP projects in development as positive examples of investment into the state.

Population power

A healthy economy also needs people to power it ... and that means sustained population growth.

South-east Queensland is set to boom with a massive 480,000 houses more than the predicted 750,000 homes needed by 2040 to accommodate its growing population, according to senior infrastructure planners.

By 2041, the south-east corner of Queensland is forecast to be home to 5.5 million people (compared to 3.05 in 2011), a 15% higher growth rate than previously predicted.

Retail revival

You won't need to go Sydney or Melbourne to immerse yourself in fashion retail therapy, with popular global fashion 'heavyweights' Zara, H & M and Uniglo eyeing off prime locations in Brisbane's Queen St Mall and some high-end European fashion/jewellery houses making Brisbane their largest store presence in Australia.

This is just one example of the strength of the south-east Queensland retail market in the eyes of global companies.

These key factors present a sunny forecast for Queensland, and especially the south-east corner.