Hannah's Tip of the Week

Early bird discount

Body Corporate fees are charged either 3 or 4 monthly, and some offer up to 20% discounts for paying early.

Be the early bird and save!

Why are Brisbane prices 'affordable'?

What is 724,000 in Sydney, 621,000 in Melbourne but only 466,000 in Brisbane? The number of cars driving through the CBD daily? The seconds of grey or rainy weather per year? Wrong!

It's the median residential property price in each of the three East Coast capitals.

Way more interesting than the prices themselves is the 'how affordable' aspect of housing.

This is when you start to get a truer picture of whether the current median prices are actually sustainable and 'affordable'.

There seems to be a distinct cycle of cities being at the forefront of housing price increases. One year it will be Sydney, another Melbourne, or Perth or Brisbane or Darwin. Unfortunately our southern friends in Adelaide and Hobart don't seem to have had their winning turn in this price game for quite some time now. Brisbane recorded 5.1% price growth in 2013, while Sydney lead the pack last year. As always, I advise to caution when looking at these figures as they represent the whole greater city region and includes houses and units. Growth may vary significantly across various suburbs or regions within a city, with houses vs units displaying further differences.

What influences housing price growth?

Population growth, economic growth and industry, as well as employment and construction are just some of the factors that influence how much a city's housing prices increase. I'm not going to go into all the various factors here, however one interesting statistic recently caught my eye...income!

Not just how much the average person earns, but the ratio of home prices to the average income. Basically, the lower the ratio the more 'affordable' a property is in terms of how many years of entire disposable income that is needed to pay for it.

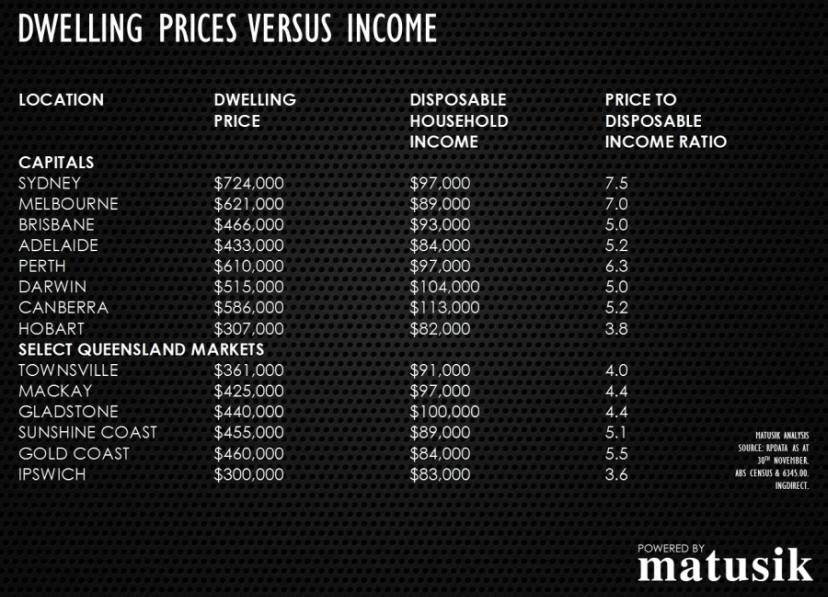

This is where it gets interesting, as can be seen from the graph* below ...

Brisbane prices are not only considerably lower than those in Sydney or Melbourne (or Perth or Canberra or Darwin) but they also have the 2nd lowest ratio of price to income. This means the houses are more 'affordable'.

But it's not just this perceived 'affordability', it also means there is definite room to move for Brisbane housing prices until they reach anywhere near the situation of the other main capitals.

In his article*, Matusik goes on to explain the impact of this on lending: how much could a person be expected to obtain for a housing loan? ...

"Assuming limited bad household debt (under $10,000 pa) & using a 5.25% variable interest rate over a 25 year owner-resident mortgage, all the markets outlined in the table (except Sydney & Melbourne) have some room to grow in terms of price during 2014. Even Perth.

"Using Brisbane as an example, the average Brisbane family household under these terms could afford to borrow up to $590,000 to buy a home. This is a big difference from the current $466,000 middle price.

In contrast, the typical Sydney family can only really afford $640,000, which is $80,000 less than Sydney's current median dwelling price of $724,000. Melbourne typical family can only afford a home priced in the high $500,000 price range. Melbourne's middle price now exceeds $620,000."

"In short, Brisbane has the capacity for some price growth. Whilst Sydney's (and Melbourne's) prices may continue to rise, there are serious limits now on affordability in both cities."

... and next week I'll be following up this theme with what various national property experts are forecasting for the Brisbane market in 2014 ...

* 'Brisbane – room to grow' article, Matusik Missive, Michael Matusik

(Source: Matusik Missive, Louise Moeller - HS Brisbane Property marketing)

To fix or to vary? ... the big Rates question

New Year's sales may be over, but home mortgagees may enjoy even further savings with fixed home loan rates from Big-Four bank, NAB, plummeting this week – but more about this later in the article.

Home mortgagees get their 'fix'

Record low interest rates are gradually changing the way people are financing their home with more and more opting for fixed rather than variable home loans. December 2013 figures reported17.4% of all home loans being fixed – that's almost 50% higher than the 10-year average.

And this strong trend is set to possibly even increase in the short-term. Although variable interest rates are forecast to remain on hold until 2015, Commsec economist Savanth Sebastian feels that home lenders could start increasing fixed rates after the next few months due to an expected increase in the bank bill rate and increasing lending rates in the USA. However, this is just what has NOT happened earlier this week, with the NAB actually cutting their fixed home loan rates.

Mr Sebastian considers now the best point to fix home loans, as "The cash rate has probably bottomed. The (fixed-rate) lows have been reached and clearly people are more and more confident of that."

Fixed rates slashed

NAB have thrown down the home-loan gauntlet, now offering their lowest fixed home loan rates since September 1993 – that's over 20 years ago! Four-year home loans were lowered to 5.44% on Monday – a reduction of 0.2%, with three-year home loans now down 0.5% to 5.14%.

This places NAB as 'cheapest' fixed home loan lender of all Australia's major banks in the 1, 2, 3 and 4 year range.

"We know that now is the time people are looking to get their finances in order as they plan for the year ahead, especially those looking to buy their first home,'' explained NAB's head of personal banking Gavin Slater. "We're really proud of our commitment to remain competitive and continuing to offer the best products with the best deals and the best service."

Will the other Big-Four banks follow suit?

Chances are 'yes' to some extent, if their past reactions are anything to go by. But who knows by how much and for how long??

THAT is the 64-million-dollar question.

... so stay tuned to this channel for more news ...

(Source: Courier Mail, Property Observer, Louise Moeller - HS Brisbane Property marketing)

Starting afresh in 2014…

Welcome to the new year, and we hope you had a great start to what is forecast to be a strong year for Brisbane property.

We're already seeing a lot of interest from buyers who are hot off the mark in 2014. Similarly, an increased number of potential sellers appear to be reassessing the market anew and getting fresh appraisals for their properties. There is a definite buzz in the air already!

To kickstart the new year we had our first newsletter ready for you outlining the trends (some unexpected) from last year and the basis that will provide for the 2014 property market.

Click here to view our January Newsletter.

That's not the only activity that's around – we're also back fresh with great new ideas and activities for 2014 – but more about that later.

We'd love to hear from you – what you'd like us to research and write about; what issues are most important for YOU the buyer and/or seller and/or someone simply interested in keeping up to date on what's happening in the Brisbane CBD. Simply Email me.

I look forward to hearing from you!