HS Brisbane Property Quarterly newsletter

Our HS Brisbane Property Quarterly newsletter is out and, as usual, full of helpful tips and the hottest news!

Highlighted in our latest online edition:

what the low interest rates mean for the end of 2014 and into the new year

insights into what impacts on the long-term value of a property

crucial information on how renting out your personal parking space may be illegal!

plus some handy tips to getting yourself sorted for the new financial year!

The demand for inner city rental properties driving Brisbane investors to the CBD

As 2014 flies by one thing is certain, Brisbane’s inner city continues to buzz! With the surge of cafes and bars popping up in the CBD, the ease of public transport and added exposure from international events such as the G20, Brisbane continues to see an increasing demand for inner city rental properties - and this is not going unnoticed by investors!

“Over the last year, I have seen a change in direction in regards to people’s desires. They are wishing to be in the heart of it all - the pubs, the cafes, the shops, the entertainment and many people are choosing to rent long-term, opting for funky inner city apartments rather than purchasing their house and picket fence in the suburbs”, said Hannah Schuhmann, Principal of HS Brisbane Property.

Two bedroom apartments have without a doubt trumped Brisbane’s rental market over the last 12 months, with statistics showing a record growth. In a recent research project undertaken by Brisbane property firm Place Advisory it showed that throughout 2013 there was an 11% increase in new rental tenances with 3,108 new bonds signed for two bedroom apartments, compared that just 1,807 signed for one bedroom apartments and 608 for three bedrooms.

"This is really interesting data and very encouraging for investors coming into the market. We are definitely seeing a encouraging growth and receiving a great deal of interest in two bedroom apartments at the moment. It’s without a doubt, the perfect time to invest" said Hannah.

Some of the other findings that have come out of the Place Advisory research project provide other great insights into the current market place:

- Public transport was actually noted as a top priority for property investors showing that 70% of investors regard being close to transport as a must have.

- 64% of investors felt that being close to the city was a top priority also.

- 62% of the investors advised that having access to retail and entertainment options was top of their list when it comes to choosing an investment property.

This again puts the Brisbane CBD at the forefront when it comes to the right location for investment properties in Brisbane, it truly does tick all the boxes! For more information contact Hannah today on 0419 782 133.

"Brisbane" by Troy Faulder

HD Media Source http://500px.com/hdmediasource

How you can use this years tax return to potentially save you thousands and pave the way for your future investments…

Every year around July we face that same decision… what to do with our tax return.

That little present we receive from the Australia Tax Office for working hard and diligently paying our ever increasing tax bills each year. For many this rebate, which can be anywhere from $500 to tens of thousands of dollars, is used on ‘the nicer things in life’ or ‘splurge money’. A holiday, that new designer handbag or professional golf clubs you have been eyeing off for months… but there are ways you can use this years tax return to make a real difference to your financial future.

With a little forward thinking and planning you can really make your tax return benefit you in the long run, especially in terms of your mortgage and building equity. In return, paving the way for buying more investment properties and increasing your wealth in the future.

“Australians, who simply apply their tax returns to their mortgages, rather than purchasing those unnecessary, but rather fun ‘in the moment items’, will benefit themselves in the future. It’s all about smart investing”, said Hannah Schuhmann, Principal of HS Brisbane Property.

Applying your tax return repayment towards your mortgage could cut your loan time by years and saved you tens of thousands of dollars.

For instance, if you receive a tax return of $2,000, and you put that money straight into you $300,000 mortgage - you already have the opportunity to save around $7,000. That is just in interest for the duration of the 30-year mortgage.

Continue to do this annually, and over 30 years you could see an approximate saving of $77,000*, consequently slicing your mortgage repayment period by six whole years and getting you closer towards financial freedom!

It’s really that simple - smart thinking and repetitive tax return repayments on your mortgage can help bring your dreams to reality! Talk to your accountant today about your options and how you can use this years tax return as a stepping stone to your next investment property.

* Based on current interest rates and a $2000 a year deposit.

Property depreciation – reducing your taxable income

All around the country people are frantically pulling all of their financial information and tax related documents out of the filing cabinets to prepare their yearly returns for the Australian Tax Office (ATO). When it comes to your property and in particular, your investment property, it is vital to ensure you are claiming all your entitlements to make the most of your asset!

Just like a car, when you buy a property, be it a unit or house, the contents start to depreciate in value. The ATO enables investors to claim depreciation on certain items like fittings and fixtures at the end of every financial year. This certainly can add up over the years and getting it right means more money back in your pocket come tax time each year!

source: http://onproperty.com.au/

The first step to claiming depreciation on your asset is to get in touch with a professional! A tax depreciation company will come and conduct a thorough inspection of your property. The specialist will generally need to spend some time on site at the property measuring and photographing eligible depreciable assets and recording all the necessary details.

After the inspection they will prepare a detailed tax depreciation schedule showing how much value each of those items will lose (depreciate) every year for up to 40 years.

“Having a tax depreciation specialist come and visit your property and put together the report for you is so easy and can make such a difference come tax times”, said Hannah Schuhmann, Principal of HS Brisbane Property.

When it comes to choosing the right company to prepare the report we suggest first ensuring they are a member of the industry body the Australian Institute of Quantity Surveyors. This means that they are registered and most likely more up to date with the most current rules and policies from the ATO. You can check if a business is a member of the AIQS on the website http://www.aiqs.com.au/ in the ‘find a member’ section.

Hannah suggests to speak to your Real Estate Agent to find out which company did the original Depreciation Schedules for the building, as they would have more detailed information in regards to the building costs etc and may be able to prepare a more precise report.

As another plus, the actual fee for having the one off report down is also tax deductible so it’s a win win! Have a chat to a depreciation specialist today and see what it a difference it could make when it comes to your tax return for this year!

National Real Estate Market: The financial year in review

Though Christmas feels like but a minute ago, this week we found ourselves welcoming in the new financial year – and a welcome change it is! Over the past few months we have seen the launch of a controversial budget and subsequently, consumer confidence taking a hit so now as we look to the new 2014/2015 financial year and put the past behind us, it is great to hear things are indeed looking strong for the real estate market!

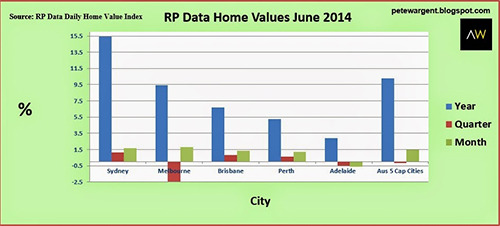

A great way to check out the current trends, and what has been happening in the market across all the major cities, is to look to the RP Data Daily Home Value Index.

As we look at the statistics for the capital cities in recent times we can see while Melbourne and Adelaide had a decline over the last quarter, again Brisbane was a solid performer with a 0.83% price rise falling just short of Sydney’s 1.14% increase.

“We’re not surprised that Brisbane has once again come out on top over Melbourne, Adelaide and Perth. Our city has so much to offer and the investors are taking note”, said Hannah Schuhmann, principal of HS Brisbane Property.

“Though we saw a slight drop in the market all across Australia in May, over the last month things are definitely started bouncing back and it means overall Brisbane has still come out on top for the quarter with a 1.5% increase in values” she said.

“While Sydney has taken the lead for growth this year with a staggering 15.5% rise, this can actually be in Brisbane’s favour. Sydney is rapidly pricing many families, owner-occupiers and investors alike, out of the market with their soaring prices. While Brisbane has also enjoyed positive growth for the year, we still remain an attractive and attainable option for buyers looking to get a good property, in a great location with the potential for growth also” said Hannah.

We will be keeping a close eye on the RP Data’s Daily Home Value Index and will keep you updated here on our blog.

We wish all our readers all the very best for a fantastic new financial year!