Federal Budget 2014

Over the past few weeks there has been one topic that has been the darling of the media, the 2014 Federal Budget. In the weeks leading up to the announcement it was all about pondering the potential gloom and doom it could mean for the average Australian citizen, and where we were most likely to see cuts as the Abbott government delivered their first Federal Budget.

Post May 13, we have seen every media portal put forward their analysis on the new budget and where it did, and did not live up to the drab expectations they had so fiercely put upon it. From health cuts to newly formed taxes it certainly has stirred up some controversy and emotion from all corners of the country. What we are really interested in, is how the newly released budget is going to affect the residents of Brisbane and in turn, what influence this may have on the inner city property market going forward.

To do this we will take a quick look at a few key demographics and what changes the 2014 Federal Budget will mean for them:

First Home Buyers

First home buyers took a particularly bad hit with the budget with the axing of the First Home Saver Accounts Scheme (FHSAS). The FHSAS was initially established by the Rudd government in 2008 as a way to further entice new buyers into the market. The scheme offered those saving for a deposit for their first home incentivising tax breaks as well as monetary contributions from the government. At the end of 2013 there were over 46,000 accounts containing in excess of $521 million dollars.

The announcement of the termination of this scheme will see the government contributions end on the 1st of July this year and the tax and social security concessions withdrawn from July 2015. This may see a decrease in the number of new home buyers entering the market long-term however presents a wonderful opportunity over the next 12 months (before the scheme disappears in July next year) for those 46,000 account holders to make the most of their share of the $521m currently saved and purchase their first home or unit.

As the deadline of July 2015 draws nearer we are more likely to see an influx of new entrants into the property market, with inner city units/townhouses likely to be a crowd favourite.

Those nearing retirement

The proposed rise to the pension age / superannuation preservation age, will see retirement delayed for many older Australians. While superannuation will still be a essential means of preparing for retirement we are likely to see an increase in the number of Australian’s diversifying their investments and savings. This is where we could see some further action in the real estate market as more investors look to property to expand their portfolio.

Properties in the inner CBD of the major capital cities such as Brisbane present an attractive option to these such investors looking to spend under $500k but still achieve good returns and long-term growth.

Families – changes to taxes & benefits

The rules governing Family Tax Benefits have been drastically tightened with the income threshold dropping from $150k to $100k, and it will mean around 570,000 families around Australia losing their entitlement to the Family Tax Benefit Part B.

Wealthy Australian’s earning more than $180k a year will also be hit with an additional 2 per cent income tax to pay off the nations’ debt.

While these changes are not going to be welcomed by many and initially may hit the hip pockets of many Australian families quite hard, there have also been some positives to come out of the budget.

One of the big wins was confirmation that negative gearing tax breaks will remain intact for the next 12 months, allowing investors to breathe a sigh of relief. Another announcement welcomed by the real estate industry in particular was verification that the Capital Gains Tax (CGT) free status will remain untouched for owner occupiers. Changes to CGT in the other direction could have had a negative impact on the affordability of properties for many families so this is definitely good news for those looking to buy or sell in the coming year.

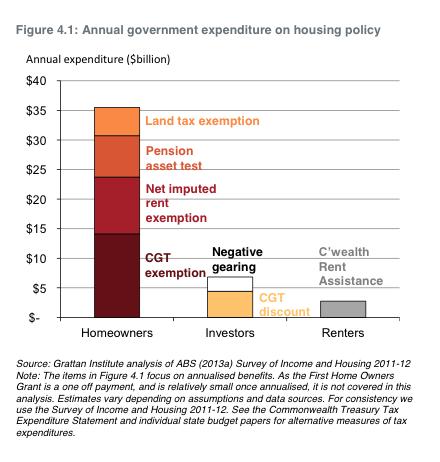

Data from the Grattan Institute suggests that 90 per cent of private housing subsidies generally go to property owners over private renters (see graphic below). This includes around $30 billion CGT benefits for owner occupiers and $7 billion negative gearing for landlords per annum.

If you, like many, after reading pages of budget analysis from all over the web are having trouble ascertaining exactly how the budget is going to affect your particular circumstance - we suggest you view the interactive ‘Budget Calculator’ the Courier Mail has put together. Simply visit http://www.couriermail.com.au/business/federal-budget-2014-calculate-exactly-what-it-means-for-you/story-fnihpj8r-1226916514203#, scroll down to the end of the page, answer a few questions about your circumstances and it will give you a rundown of which changes will directly affect you this year.

(Source: 'Industry Experts on Australia's 2014 Federal Budget', Property Observer - May 12, 2014; See more at: http://www.propertyobserver.com.au/forward-planning/investment-strategy/politics-and-policy/31155-property-observer-exclusive-industry-experts-on-australia-s-2014-federal-budget.html)

Brisbane CBD Property Market : January-May 2014 snapshot

It only seems like a few short weeks ago that we were looking ahead at what 2014 had in store for Brisbane CBD's property market.

And now, with over a third of the year gone, how did the forecasts stack up?

Has the positive 2014 property outlook been reflected in actual sales? Who's buying? Who's selling? ... and at what price? How is the rest of the year expected to develop? How does 2014 compare to previous years?

Forecast vs Reality

Brisbane's CBD has recorded* an extremely strong first 4 months of 2014, reflecting the forecasts made in January. Our CBD property sales are at levels not seen since 2007 - the peak year in the last decade - and bode well for the remaining months of 2014.

Forecasts from property analysts in January included:

"Brisbane is only just now starting to take off and I see much stronger growth there – perhaps over 10%."

"Brisbane is still playing catch up [to Sydney and Melbourne] and, with lower price options, it will likely continue its upward trajectory.

Reality is proving the forecasts to be correct. Buyer interest is from a broad cross-section of local, regional, interstate and overseas buyers. While some sellers are adopting a 'wait and see' approach, the tide is starting to turn with others realising the opportunities that the current market and buyer interest brings. Price growth is set to reach forecast levels if it continues at the current rate of the last 4 months.

One of the biggest surprises is how strong the sales have been compared to similar periods over the last 10 years.

Interestingly, both Buyers and Sellers are the same type of people - 73% are investors, and 27% owner occupiers. However, some investors buying up CBD apartments are planning to also live in it or have family members live in it for certain periods of time, renting it out for the rest.

Who's buying? What and Why are they buying?

Queenslanders are still the main buyer group in the CBD marketplace. There has, however, been a decided increase in the number of interstate and overseas buyers - from around 25% in 2013 to just on 40% for 2014 so far. It will be interesting to see whether this trend continues short and mid-term.

As mentioned above, investors are in the majority once it comes to buying CBD property, but there are several interstate, overseas and also Queensland buyers intending to rent out the property most of the time and use it themselves when in Brisbane or have their kids live there whilst studying in Brisbane. This is becoming an increasingly popular option.

Buyers also come from the Baby Boomer generation, wanting to down-size from their suburban house to a more practical living solution.

It's no surprise that two bed apartments are still the favourite, with 60% of buyers choosing this type of CBD apartment. Interest in one and three bed apartments is exactly the same as in 2013, so buyer apartment type preference remains stable.

Brisbane CBD property is also perceived as being 'better value' than Sydney for some interstate investors, and for some European nationals a better place to park their money than in their homeland.

Who's selling? Why are they selling?

Changing investment and business options/plans, and retirement are main reasons for selling. We are also starting to see young professionals now moving on with their family planning and wanting a house & garden for their potential family. This not only true for owner occupiers but also some investors wanting to access the funds tied up in their CBD investment apartment.

Property prices

Average property price for the first four months of 2014 has increased 10.5% compared to the same time period last year. This means the Brisbane CBD is on track to achieve 10%+ growth for 2014 if current trends continue for the rest of the year.

How does 2014 compare to previous years?

Once it comes to actual CBD apartment sales it's a real eye-opener. Sales levels (number of properties sold) for the first months of 2014 are comparable to 2007 - the strongest year in the 10 years of my real estate agency. 2013 also started off strongly but not at the levels we're seeing in 2014.

This again is cause for optimism in the Brisbane CBD property market for the remainder of 2014.

Forecast for the rest of 2014

The good news is that the strong start to 2014 in Brisbane's CBD is expected to continue throughout the year. Effects of the Federal Budget announced this week may impact some areas of property however property analysts do not expect any resultant major changes to the property market. It will be interesting to see if seasonal fluctuations and the G20 meeting of world leaders has any effect on buyers, sellers and the CBD property market.

I anticipate that the global coverage and focus on Brisbane from the G20 will create follow-on interest from people overseas who may have not previously considered the 'little cousin' of Sydney and Melbourne in their property research or plans - in particular, the CBD.

If current trends continue at the same comparative seasonal rate then it's set to be a bumper of a year for Brisbane's CBD property market.

Full steam ahead!!

* All statistics based on HS Brisbane Property sales statistics January - May 2014

(Source: 'Experts upbeat about Brisbane', HS Brisbane Property Market - February 6, 2014; Louise Moeller - HS Brisbane Property marketing consultant)

Lessons to learn on Population growth

Up one decade, down the next ... the ever-changing dynamics of a country's population affects the whole economy, GDP and also property.

We talk a lot about 'supply and demand' within the property market - lots of people means lots of housing needed, either to rent or buy.

But what happens when bit-by-bit the population of a strong world economy decreases? What's the outlook for Australia long-term, and its important economic partners? How does this all affect investing in Australian property today and in future years?

How population affects economic powerhouses ..

Remember in the late 1970s and 1980s when the one country powering ahead on the world economic platform was Japan. Their continuing economic and industrial growth seemed unstoppable.

Let's go back even further to 1950 where the only big name in the global automobile industry was Detroit.

What do Detroit and Japan have in common? Both their economies suffered, not just slightly but dramatically from a decline in population. While Japan faces a huge older population with low birth rates and many young people leaving for challenges and a life abroad, Detroit's population has fallen by an incredible 60% since its 1950s hay-day due to the strong decline in the American car industry.

Dateline 2014: China

China has quickly risen to become one of Australia's main trade partners. Perhaps you could call them 'the Japan of the 1980s' for Australia in economic terms. Therefore every minor change in the Chinese economy is given strong significance here, although it may actually just be a natural 'adjustment' within the country's economic growth. A case of 'China sneezes and Australia gets the flu'.

Rural-Urban shift

One of the biggest changes we're seeing in China is the movement of a traditionally large rural population to the cities. In fact, analysts forecast that around 300 million people in China - that is 3/4 of the entire population of Western Europe, or almost 13 times the whole Australian population - will move from country life to city life this decade. The daily needs, sudden accessibility to 'every day' lifestyle and living products is sure to fuel huge increases in spending on consumer products, as long as jobs are available.

The long-term effect of this demographic change is expected to ensure continued strong demand, though possibly not at the levels we're currently seeing. It's good news for the Australian economy, and also has another positive effect on property - the demand for Australian property from Chinese nationals.

Australia's long-term population forecast

... continuing sunny and warm. Australia is in the lucky position, compared to many Western Countries, to enjoy a solid national population increase and net migration from overseas. The current rate of natural increase (births vs deaths) is at record highs. In a 12-month period until late 2013 natural population grew 1.8%. Migration from overseas is still strong and this will also see further sustained population growth in the future as birth rates for migrants is overall stronger than for the current population of 'Australians'.

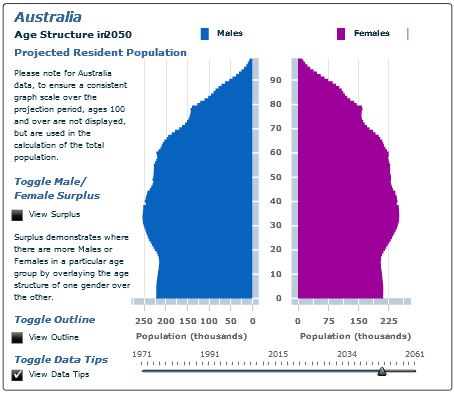

This means that Australia, unlike many Western countries, is not expected to suffer a so-called 'demographic cliff' of predominantly older people and very few younger people. The forecast for Australia's population in 2050 is for an estimated 37.6 million people with a healthy bell-shaped age demographic curve.

Source: ABS

What does that mean for property investors?

Take, for example, property investors in cities like Sydney, London and, yes, Brisbane. As the populations have continued to grow so has the property market. Strong population growth does not always mean strong property price gains, however it seems logical that a country / city with strong population forecast and a range of industries and business sectors (not like Detroit with its strong car focus) makes simple property investment sense. This way the cyclic property waves can be minimised against long-term growth.

(Source: Australia Bureau of Statistics, Property Observer - Peter Wargent; Louise Moeller - HS Brisbane Property marketing consultant)

Hannah's Tip of the Week

Provide details & avoid delays

If you're buying property, then provide your full contact details - name, telephone and email details - to your solicitor as soon as possible before signing a contract. This helps avoid potential delays later on.

Brisbane CBD property market: What people are asking

CBD property questions from my buyers and sellers are some of the most interesting aspects of my daily work. The number and type of queries I get asked is truly endless, so in this edition I'm addressing two key questions that people are asking right now about Brisbane CBD property ...

Q: "Why buy in the CBD when there are so many buildings going up in other inner-city suburbs"

A: The key is 'Location, Location, Location'. Near the city centre is not the same as in the city centre. If you have tenants then they want to be near where they work or study, and ideally be from home to work/study within a few minutes - and not have to catch a bus or train, no matter how few stops are needed.

Floorplan, size & price: New is always nice and fresh, but after a year or two, either living as owner or tenant, that 'new and fresh' feel often changes to a sobering 'practicality, size and floorplan' feel. A well-maintained established property with good track-record, larger size and room to move and live, is often a more attractive long-term option. Compare the price per m2 and you may get a real surprise - just because a new apartment is a suburb or two from the central CBD doesn't mean it's cheaper.

... and remember, a coat of paint and a few new appliances, furnishings and accessories won't cost you the world but can also make the world of difference to an apartment.

See below BEFORE and AFTER photos of a renovated 'Rothbury on Ann' apartment

Rental return: Do your homework very thoroughly! Check the rental history of the suburb, building and surrounding similar buildings. Not just the actual rent, but also occupancy rates are important. If you're considering a new building in an inner-city suburb, ask: what happens after the 2 year rental guarantee period finishes? The rents usually returns to being what the market is prepared to pay, which may be quite different to what you were getting til then, or the occupancy rates may drop.

...and last, but definitely not least ...

Brisbane CBD is Australia's most-wanted living address: Latest figures from realestate.com.au show that, over the last 6 months, more people were searching for apartments to rent in Brisbane's CBD than anywhere else in the country!

Q: "Would my CBD unit sell at a better price if it is in the short term letting pool or with long-term tenants?"

A: It's not a simple 'yes' or 'no' answer, but has many aspects to consider:

- Is the current long-term tenant tidy and the unit presents well? The first impression is often the most important, so if your property is well cared-for then this speaks highly of the tenant and also of the condition of the unit.

- How long is the lease? Ideally, a property with a long-term lease is best placed on the market approximately 2-2.5months before the existing lease expires. This way the unit can be marketed to both owner occupiers and investors.

- Lending: Banks tend to prefer long-term tenants and owner occupiers, so any potential investor may find it easier to obtain finance with a long-term lease in place.

- Having said all that, short-term leases do have their advantages. If it is leased through a building/property manager such as the Oaks Group, then, generally speaking, there may be more opportunities to show the property to prospective clients.

- Furniture Packages put in by the building/property management may become an issue if a buyer wants to move in and not use that furniture. The residual value may have to paid back to the property manager if it falls within the first 2 years of the lease period, and therefore affects the price.

... In a nut shell ...

if the rental return per annum is similar for both, the long term tenant is tidy, and either the Furniture Package is owned by the seller or there is no pay out (i.e. first 2 year lease period is over), then either option should achieve an optimal sales price.

YOUR questions? What's on your mind? Feel free to ask me your Brisbane CBD questions and I look forward to getting back to you. My 18 years of CBD property expertise provide a exceptional background and scope of information that I'm really happy to share with you - just ask!

(Source: Louise Moeller - HS Brisbane Property Marketing Consultant)