Latest survey reveals growing confidence in Brisbane’s property sector

Results from the recent ANZ/Property Council Survey* are in, revealing growing confidence in Brisbane’s property sector and indicating that Queensland is up there with the best of them!

The survey shows that property confidence for Queensland has risen by two points since the last quarter, making the state now sit at 132 on the index. This positive result puts the state ahead of the national average and considerably above the neutral score of 100.

The other good news is that Queensland was only one of three states to see a bump in numbers this quarter, other states that crept up were the Australian Capital Territory and Northern Territory.

In a response to the survey, Queensland Property Council Executive Director, Chris Mountford, said the state government’s “key economic initiatives” will only help reinforce further confidence. Such initiatives include: new planning legislation, a new State Infrastructure Plan and a new south-east Queensland regional plan.

“The government’s success in delivering these key strategic initiatives will shape industry confidence over the next few quarters,” he said.

“Given that property is Queensland’s biggest industry, providing 240,000 jobs across the state, these reforms must be priorities 1, 2 and 3 for the government.”

“A more confident property industry will translate directly into more jobs, greater prosperity and stronger communities right across Queensland.”

Treasurer Curtis Pitt agrees with Mountford, saying that the two-point rise is certainly positive news for the state.

“It’s very encouraging to see confidence in the Queensland property industry is on the rise,” he said.

“The Property Council acknowledged that our positive economic policies are one of the key factors behind this increased confidence.

Mr Pitt also said there were several major developments in the pipeline for Brisbane, which could potentially generate a further rise to our local economy.

“Work is already underway on the Queens Wharf integrated resort development in Brisbane… other proposed developments such as the Herston Quarter in Brisbane are also being progressed,” he said.

“These projects have the potential to create thousands of jobs and generate economic uplift in Queensland.”

Another person to welcome the news was the Opposition’s Tim Nicholls who says one of the underpinning reasons for the positive shift is the economy.

“I think what we are seeing, what is occurring in Sydney and Melbourne, as the prices there are reaching their peak, (is that) people are looking for a value proposition and there is a value proposition in Brisbane and Queensland which is encouraging people to invest here,” he said.

With all of these developments in the pipeline and more positive news from industry surveys (once again), it is very apparent that Brisbane’s property industry is moving in the right direction – which is definitely music to the ears for any local investor.

To find out what investment opportunities are currently available or new listings about to hit the market here in the Brisbane CBD, contact Hannah Schuhmann, Principal of HS Brisbane Property, on 0419 782 133.

* The ANZ/Property Council Survey is the nation’s leading measure of industry confidence, with over 2,200 respondents across the country participating in the survey.

5 tips when it comes to maximising tax savings

Last week we took a look at depreciation in property assets and highlighted just how important a depreciation schedule can be for any investor. This week we thought we would delve a little further by exploring other ways an investor could get the most financial benefit come tax time - tax deductions.

Before we start, let us quickly retouch on depreciating assets...

As we mentioned in last week’s write up, when purchasing a property, the contents start to depreciate in value – these are the depreciation assets; items within the property which are not attached to the structure of the building and whereby their value deceases over time. Think curtains, carpet, clothes dryers, light fixtures and the like.

Depreciating assets are probably one of the more complex things to claim, which is why it serves you well to speak with a quantity surveyor like the experts at Napier & Blakely who appeared in last week’s story.

Why is it more complicated you ask? Because buying a depreciating asset is not typically considered an upfront tax deduction. However, the cost of a depreciating asset is tax deductible over the effective life of the asset. Meaning, the dollar signs can certainly add up over the years.

The key, for any property investor, is to claim as many tax deductions as they are legally entitled to. After all, every tax dollar you claim goes towards your overall investment return and financial wealth so the more deductions investors can claim on a property, the higher their tax benefit. For that reason alone, it is vital not to overlook them. That being said, here are five common deductions that may be made on negatively-geared investment properties.

1. Interest

In a negative-gearing investment property, interest is certainly one of the biggest tax deductions that can be made. This refers to the interest incurred on money borrowed against the property, including purchasing the property, undertaking repairs and managing tenant-related issues.

2. Repairs and maintenance

Plastering up cracks in the wall, fixing an oven that has stopped working, repairing a leaky tap, replacing a broken window… all of these are legitimate tax deductions when it comes to a rental investment. They come under the banner or repairs and maintenance, which, in the investment world, means restoring something to its original condition due to tenant wear and tear. Talk to your advisor to find out what repairs you are eligible to claim in the coming year.

3. Tenancy costs

There are a multitude of tenancy costs that can be included as possible tax deductions. Some of the most common ones include advertising costs, letting fees, landlord insurance, lease agreements (preparing new ones and amending existing ones) and legal costs required to evict a tenant.

4. Travel

Travel is one of the not-so-obvious tax deductions and can often tend to be overlooked. This deduction encompasses the cost of travel to inspect the rental property whether that entails motor vehicle deductions (for local properties within driving distance) or even airfares (for properties interstate). Make sure you get all the information on this one from your financial advisor as there are strict regulations in terms of the portion of your ‘trip’ and the amount you can claim back.

5. Other holding costs

Another tax deduction that may be claimable are a property’s holding costs; basically any monies spent on the overall management and upkeep of the investment property. We are talking anything from cleaning, gardening, security monitoring and pest control to body corporate fees, council rates, building and contents insurance premiums and property management fees – these may be claimed as a deduction so ensure you speak to your tax agent about these costs and if it is something you could be entitled to claim back.

So there you have it... for some investors this article might serve as a simple reminder, while for others it may have uncovered some golden opportunities which can now be discussed with a trusted financial consultant or accountant.

Here at HSBP we want to help build your investment portfolio through sound industry knowledge, first-class service and exclusive opportunities to purchase some of the best investment properties Brisbane has to offer.

This includes limited offers that can take your investment to new heights, like the following promotion we launched today whereby any of our clients that sign a contract with us in October will receive access to a free depreciation schedule from NBTaxupon settlement of the property.

For more information on how we can grow your investment including how you can redeem the above promotion, speak to the professional consultants at HSBP on sales@hsbrisbaneproperty.com.au

Why a property depreciation schedule is a must for any astute investor

Preparing a tax return for the Australian Taxation Office (ATO) can prove a rather hectic exercise for anyone, let alone an investor. However, it is one that can prove very rewarding if done correctly. From our perspective, the key to getting the most out of your assets is to ensure no stone is left unturned! This means claiming all possible entitlements… starting with making the most of property tax depreciation.

Whilst June 30 has been and gone it certainly does not mean tax time is over. The lodgement period for 2014/2015 tax returns runs from July 1 until October 31. So while advertisers may have stopped singing to the tune of happy EOFY for another year, the time to lodge tax returns is still well and truly among us - at least for another month anyway.

As we know, when purchasing a property, the contents start to depreciate in value - much like a car. Thankfully the ATO enables investors to potentially claim this depreciation on certain items (like fixtures and fittings) at the end of every financial year. In this case October 31.

Such depreciating assets can certainly add up over the years. For that reason alone, it is really important not to overlook them.

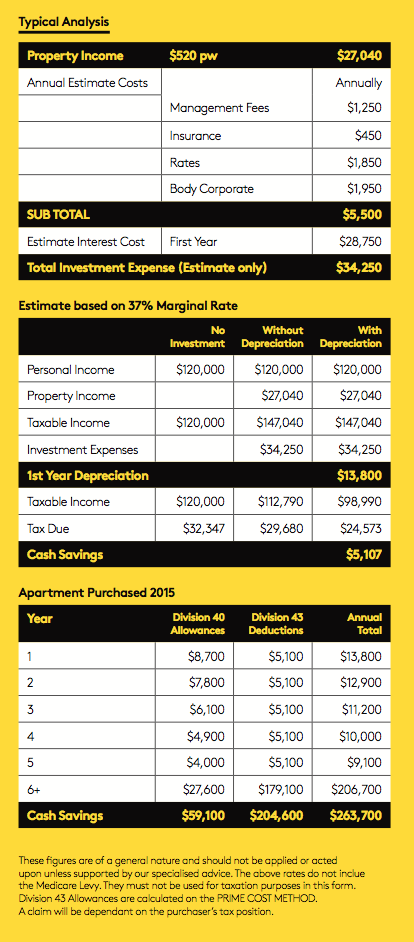

For instance, let us take a look at an example by consultants,NBtax by Napier & Blakeley of a typical analysis:

This example perfectly highlights why it is imperative for investors to devote much-needed time and resources into a quality depreciation schedule. Clearly the results of a professional schedule are extremely beneficial and, if done right, have the power to increase the figures of an investor’s bank balance come tax time.

Before starting the first thing to do is find an expert property depreciation specialist; someone who will conduct a thorough onsite review of the property – this includes measuring, photographing and recording all eligible depreciable assets. Following the inspection they will also prepare a detailed tax depreciation schedule showing how much value each item will lose (depreciate) every year, up to 40 years.

Hannah Schuhmann, Principal of HS Brisbane Property, says there are numerous benefits to having a tax depreciation specialist, such as a quantity surveyor, come out and visit the property.

“Having a quantity surveyor inspect your property and compile a report is so easy and can take away a lot of stress from an investor. Best of all, it can make the world of difference come tax time”, says Hannah.

Hannah believes another major advantage of commissioning a specialist to help calculate depreciation is that it provides a transparent overview of what can, and cannot, be claimed. Thus, allowing the investor to have more control of their assets – not their accountant.

Chris Page from NBtax by Napier & Blakeley, could not agree more.

“Most accountants recognise that using a quantity surveyor saves you time and money and puts you in the driving seat when it comes to good asset management; ask yours how they are making the most of the opportunities available to you”, said Mr Page.

So the question remains… how to find the right quantity surveyor to prepare that special report? Hannah recommends finding someone who is a member of the professional industry body, Australian Institute of Quantity Surveyors (AISQ), and is a registered Tax Practitioner.

So, whether you need a new report or would like to have someone look over your existing schedule, finding a depreciation specialist is a great start towards making a big difference to that next tax return.

For more information on this and other profitable investment tips, speak to us at HSBP on 0419 782 133.

Brisbane ranks as one of world’s top 20 most liveable cities

Last month The Economist’s Intelligence Unit (EIU) released its annual Global Liveability Ranking Report for 2015 – and, this year, Brisbane made it to the list’s top 20! Once again proving that there is only bright skies on the horizon for our sunshine state.

According to the latest Global Liveability Ranking Report, Brisbane is currently ranked 18th when it comes to the world’s most liveable cities. That is a very steady climb on last year when the city came in at number 20.

While Brisbane gets the tick of approval from its locals, now the secret is out thanks to reports like the recent one by the EIU. A shining reminder to local and global investors as to why they need to devote their time and energy into fast-growing cities, like Brisbane, that are on their way up.

According to Hannah Schuhmann, Principal of HS Brisbane Property, this is really exciting news for Brisbane’s real estate market because as the city goes from strength to strength so too does the demand for local property.

“Over the past 12 months we have experienced an ever-increasing demand for city living. Now, more than ever before, buyers and tenants are opting for a place that goes beyond bricks and mortar… they want convenience and an easy lifestyle where everything is only a stone’s throw away,” said Schuhmann.

“This typically leads them straight to the city and snapping up quality apartments within the Brisbane central business district (CBD).”

“It’s an exciting time for real estate here in Brisbane; the city is in a state of renewal and growth, which can only be good news for any investor,” says Hannah.

The best way to quantify whether our level of supply matches the level of demand, is to take a look at the vacancy across the different areas - this is where the Brisbane CBD truly comes out on top!

So, while we are witnessing many new buildings being developed in and around the Brisbane CBD, the demand for rental properties still remains sought after. This means that people investing in the city are in an even stronger position today than they were two years ago.

For more information contact Hannah Schuhmann on 0419 782 133.

The future of real estate

Recently on Friday 21st August we had the pleasure of attending Core Logic RP Data’s Mega Trends Masterclass here in Brisbane. This encompassed an abundance of information by a host of industry leaders, including a fabulous presentation by Greg Dickason. It was called ‘The Future of Real Estate’.

Greg’s seminar offered a wealth of knowledge. However, one of the key points that came from his session was to ‘be generous and share your expertise’. On that note, we thought we’d take this opportunity to reveal the seven core messages that Greg discussed in his presentation.

The connected community

Let us start by first saying that Greg’s presentation was a real eye-opener into the world of real estate and how it is ever-changing. Greg covered what he considered to be the latest megatrend – the connected community! This looks at how the internet plays an important role in connecting today’s mobile buyer in a world where everything is connected - gone are the days where distance forged any hurdles because nowadays everybody is just one click away.

Get ready for the bang!

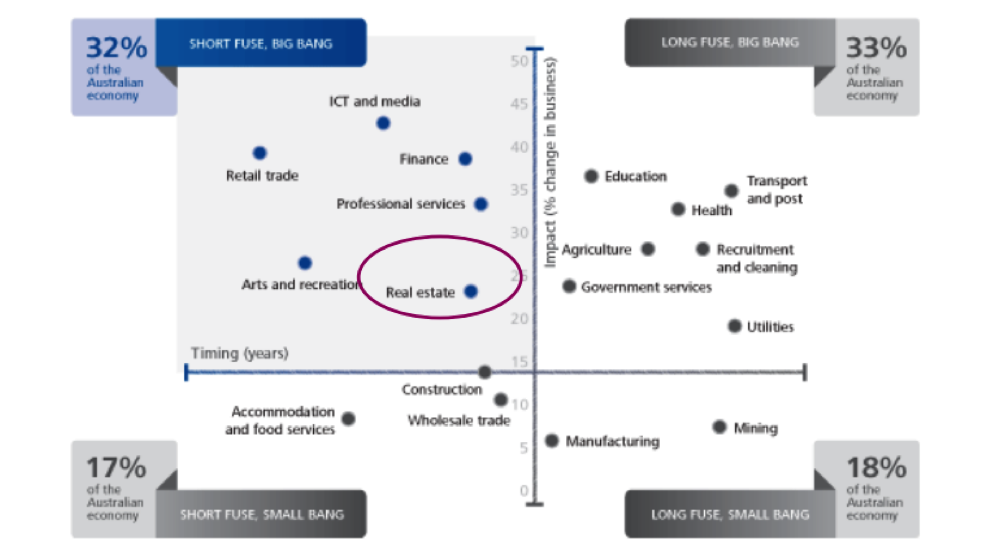

Greg talked about something called the ‘innovation disruption curve’ – this looks at industries that are affected by technology and then put on a chart outlining which will be most affected. Real estate sat smack bang in the group, which he suggested made up 32 per cent of the Australian economy and was likely to have the harshest impact – he called it a ‘short fuse with a big bang!’

Long live the cloud

What is driving this new change? Dickason says it is a plethora of technological components, one of which is the cloud. That space where everything on the internet exists and information is available – always!

Always on but seldom paying attention

One of the issues that Greg raised in his presentation was this idea where today’s clients are always actively on their technology – and thus always available. However, available is one thing but getting their attention is another. These days everyone is so busy multitasking that it is proving harder and harder for businesses (including real estate agents) to cut through all that noise and clutter.

Everyone wants a piece of buyers and sellers

Once upon a time buyers and sellers were at the agent’s disposal. Not anymore. According to Greg, everyone wants a piece of the pie, including mortgage brokers, portals and media, banks, insurance companies and service providers. For the client’s perspective that is a lot of people and business trying to get their attention. Back to point four we go.

Get better at embracing change

This point was not new to us here at HSBP – just ask our clients. In fact over the years we have learnt to embrace change, not run from it. In fact, our innovative thinking and fresh approach to investing and realty is what fast paved HSBP as one of today’s leading real estate agencies here in the Brisbane CBD.

Understand the power of lifelong relationships

Again, while Greg made a big point of this topic, it was not quite so new for us at HSBP. We have been around for 11 years – a long time in our industry and something we have done based on the strong relationships we have forged with our clients. Anyone that knows Hannah Schuhmann and the HSBP team, will understand the very importance we place on the solace of building lifelong relationships.

Here at HSBP we pride ourselves as industry professionals who remain up to the minute and understand the latest industry trends – this includes attending seminars and workshops just like’s Greg’s.

We find value in information and pass this knowledge onto our clients with every conversation we share. So, if you want to speak to an innovative team that embraces change and looks toward the future, give the HSBP group a call on 0419 782 133 and set up an appointment today.