Lessons to learn on Population growth

Up one decade, down the next ... the ever-changing dynamics of a country's population affects the whole economy, GDP and also property.

We talk a lot about 'supply and demand' within the property market - lots of people means lots of housing needed, either to rent or buy.

But what happens when bit-by-bit the population of a strong world economy decreases? What's the outlook for Australia long-term, and its important economic partners? How does this all affect investing in Australian property today and in future years?

How population affects economic powerhouses ..

Remember in the late 1970s and 1980s when the one country powering ahead on the world economic platform was Japan. Their continuing economic and industrial growth seemed unstoppable.

Let's go back even further to 1950 where the only big name in the global automobile industry was Detroit.

What do Detroit and Japan have in common? Both their economies suffered, not just slightly but dramatically from a decline in population. While Japan faces a huge older population with low birth rates and many young people leaving for challenges and a life abroad, Detroit's population has fallen by an incredible 60% since its 1950s hay-day due to the strong decline in the American car industry.

Dateline 2014: China

China has quickly risen to become one of Australia's main trade partners. Perhaps you could call them 'the Japan of the 1980s' for Australia in economic terms. Therefore every minor change in the Chinese economy is given strong significance here, although it may actually just be a natural 'adjustment' within the country's economic growth. A case of 'China sneezes and Australia gets the flu'.

Rural-Urban shift

One of the biggest changes we're seeing in China is the movement of a traditionally large rural population to the cities. In fact, analysts forecast that around 300 million people in China - that is 3/4 of the entire population of Western Europe, or almost 13 times the whole Australian population - will move from country life to city life this decade. The daily needs, sudden accessibility to 'every day' lifestyle and living products is sure to fuel huge increases in spending on consumer products, as long as jobs are available.

The long-term effect of this demographic change is expected to ensure continued strong demand, though possibly not at the levels we're currently seeing. It's good news for the Australian economy, and also has another positive effect on property - the demand for Australian property from Chinese nationals.

Australia's long-term population forecast

... continuing sunny and warm. Australia is in the lucky position, compared to many Western Countries, to enjoy a solid national population increase and net migration from overseas. The current rate of natural increase (births vs deaths) is at record highs. In a 12-month period until late 2013 natural population grew 1.8%. Migration from overseas is still strong and this will also see further sustained population growth in the future as birth rates for migrants is overall stronger than for the current population of 'Australians'.

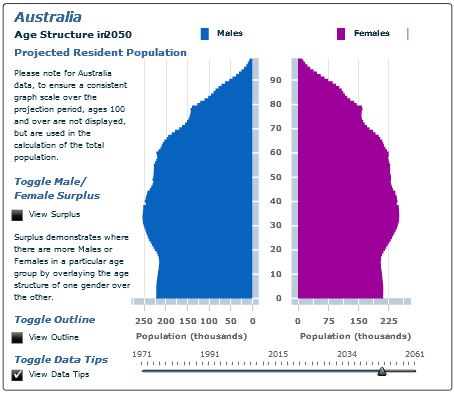

This means that Australia, unlike many Western countries, is not expected to suffer a so-called 'demographic cliff' of predominantly older people and very few younger people. The forecast for Australia's population in 2050 is for an estimated 37.6 million people with a healthy bell-shaped age demographic curve.

Source: ABS

What does that mean for property investors?

Take, for example, property investors in cities like Sydney, London and, yes, Brisbane. As the populations have continued to grow so has the property market. Strong population growth does not always mean strong property price gains, however it seems logical that a country / city with strong population forecast and a range of industries and business sectors (not like Detroit with its strong car focus) makes simple property investment sense. This way the cyclic property waves can be minimised against long-term growth.

(Source: Australia Bureau of Statistics, Property Observer - Peter Wargent; Louise Moeller - HS Brisbane Property marketing consultant)