Why rent when you can buy?

If home ownership seems like a distant dream, then think again.

And, if the title of this week's Market News (and the above sentence) seem familiar, then you're right! This was the start of my Market News back in September 27 last year.

Why am I repeating old Market News?

Because it's still true.

In fact, latest rental and residential property figures show it's truer than ever.

Back in September, in 238 of the country's suburbs renters were generally better of buying than renting, and it wasn't just the perceived 'less attractive' suburbs.

In June2012 it was 179 suburbs.

One of the bigger surprises back then was that the Brisbane CBD was one such suburb where median

rents were higher than the average cost of paying off a variable mortgage loan.

What's the situation now?

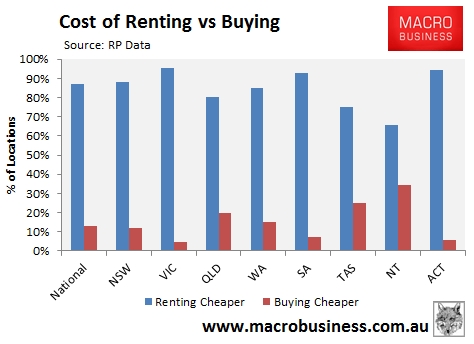

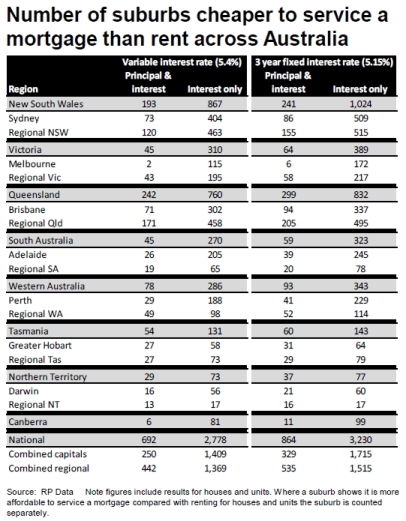

In the last 12 months there's been a staggering three-fold increase in the number of suburbs where buying is considered cheaper than renting – up to 692 from 179, according to the latest RPData Buy vs Rent Report. This report analysed monthly mortgage vs rental payment figures, based on median house/unit prices and median rents.

In the last 12 months there's been a staggering three-fold increase in the number of suburbs where buying is considered cheaper than renting – up to 692 from 179, according to the latest RPData Buy vs Rent Report. This report analysed monthly mortgage vs rental payment figures, based on median house/unit prices and median rents.

Sydney led the way with 73 suburbs, followed closely by Brisbane with 71 suburbs.

Queensland leads the other states with 242 (of the 692) suburbs.

RPData, the producer of this report, credits this sharp rise on the following factors:

"With capital city home values 2.9 per cent lower than when they peaked back in October 2010, discounted variable mortgage rates 175 basis points lower from their early 2011 peak and fixed mortgage rates 265 basis points lower than their peak, many renters and prospective home buyers are likely to be doing their sums to work out whether it is better for them to pay a mortgage or pay a landlord."

"For many buyers, now may be a good time to consider either re-entering the market or buying their first home.", explained RPData's National research Director, Tim Lawless, as continues ...

"Across the capital cities, it is typically apartment-style housing where renting can be more expensive than paying a mortgage. The buy-in price tends to be lower compared with weekly rents, providing a narrower gap between mortgage payments and rental payments."

What about Brisbane CBD and other inner-city suburbs?

What about Brisbane CBD and other inner-city suburbs?

Back to the Brisbane CBD there are sure to be some who are not so surprised with these finding - CBD tenants. Continuing high demand and very low vacancy rates have meant that there has been pressure on rents for quite some time and this is forecast to continue within the CBD centre.

However, the situation on the CBD rim, where the high building activity continues unabated, may end up being a different story. Yes, there is certainly demand for these locations but the thousands of apartments being built may trigger an oversupply in certain inner-city suburbs.